7 Money Management Tips for Your Post-Grad Budget

Personal finance management was not a subject taught during my high school days. For that reason, I was completely clueless about how to manage my money when I entered college. I remember my freshman days when I used to spend my allowance on things I wanted: I bought new sets of clothes, ate everything I like even if the dishes cost a week’s allowance, and also went to places I only visited in my dreams. Honestly, my entire freshman year in college was all about spending.

It was only during my sophomore year when I started to realize that I didn’t have all the money in the world to live a life like that of Hollywood A-listers. After a tragic financial incident that struck my family, I immediately understood the real value of money, and I started taking seriously my finances. Once I started managing my finances responsibly, I saw a significant change in my life.

From having an almost zero balance to having more than a hundred bucks in my wallet at the end of the month, allow me to share some tips on how I saved money and recovered from my poor money habits.

1. Keep track of your expenses.

Have you been in a situation where you asked yourself, “Wait, where did all my money go?” I was, too. I once spent lavishly without worrying about tomorrow’s expenses. When I realized I couldn’t keep living like this, I began to keep track of all my expenses – snacks, coffee, and even the daily newspaper I bought. Yes, I counted all of them. If you haven’t been keeping track of your daily expenses, consider reviewing your bank statements and credit card reports to see where you’re money has been going.

Though embarrassing to admit, smartphone apps weren't very popular when I graduated. Because of that, I had to bring my notepad everywhere I went to write down everything I bought. Each night, I would turn on my laptop and transfer my notes to a budget spreadsheet.

I personally recommend the iOS app that my sister uses called Left to Spend. She sets a spending amount and then subtracts all her expenses from there, allowing her to keep track of her balance.

2. Learn to budget.

Now that you have an idea on the things you are spending for every month, you can work on your expenses and fit them into a workable budget. Typical expenses to include in a budget are basics like transportation, clothes, food, utility bills, and housing/apartment.

There are a variety of ways to set your budget: If you are old school, a simple pen and paper will suffice, but you can also use an Excel spreadsheet if that is more convenient for you. There are also several apps available that will allow you to set up a budget. When in doubt about your budgeting abilities, do not hesitate to involve your family—they will likely be happy to share their money-budgeting wisdom.

3. Include savings in your budget.

After creating a budget, it is time to consider your savings. If possible, try to put away 10% of your income each month. If you think your expenditures are so high that there is no room for savings, consider cutting back on expenses that might be considered “luxuries”, like eating out or buying new clothes.

4. Set your priorities.

Your priorities in life have the biggest impact on how you handle your finances. By prioritizing your goals, you will have a better idea of when and where you should begin saving. What are your money goals? Looking to buy a new computer or purchase your first home? When you have a concrete goal in mind, it will help to strengthen your money-saving self-discipline.

5. Find discounts.

Plenty of local establishments, vendors, and service providers offer discounts for everyone, (yes, everyone!) allowing them to save.

When I was in college, I basically survived with these sorts of discounts. From restaurant coupons to services vouchers, I became a master at hunting such great deals. Even now that I am a professional, I still look for these discounts. They just ease the burden in my pocket!

Groupon is my go-to for finding discounts. You can also check the social media and websites of your favorite establishments, as sometimes, they post coupon codes to attract new and returning clients alike.

Apps like Ibotta require minimal effort and can end up saving you several dollars on just one grocery store run. Ibotta provides hundreds of rebates for a variety of stores, including HEB, Kroger, Walmart, and Target. These rebates change every week, so when you’re ready to make your shopping trip, check your Ibotta app to see what rebates are being offered. It’s as simple as selecting and unlocking the rebate, so it is added to your “unlocked deals.” Once you’ve completed your shopping, use the app barcode scanner to scan the barcode for each item and take a picture of your receipt. That’s it! It’s like free money in your pocket. You can redeem your rebates for giftcards, like Starbucks, or withdraw it as cash through PayPal.

- Use this referral code to earn an easy $10 welcome bonus when you redeem your first receipt 14 days after joining. In return, That First Year will receive $5. Wins all around!

6. Say yes to opportunities that allow you to earn.

Many companies and brands sponsor contests that aim to discover something fresh and new. As someone who has always been interested in writing, I was always on the lookout for essay writing contests and other competitions related to writing. Fortunately, I found a lot. And I even landed a spot on those contests. Though I wasn’t able to actually bring home the bacon, the money I won as a runner-up and other special prizes allowed me to earn. Plus, my experiences allowed me to hone my writing skills.

If you have marketable skills like writing or web design, freelance gigs are another income-earning opportunity. As with searching for coupons, the Internet is your best buddy in looking for contests and freelancing gigs. You can find opportunities on websites like FreeUp, Upwork, and Freelancer for potential skill-related projects.

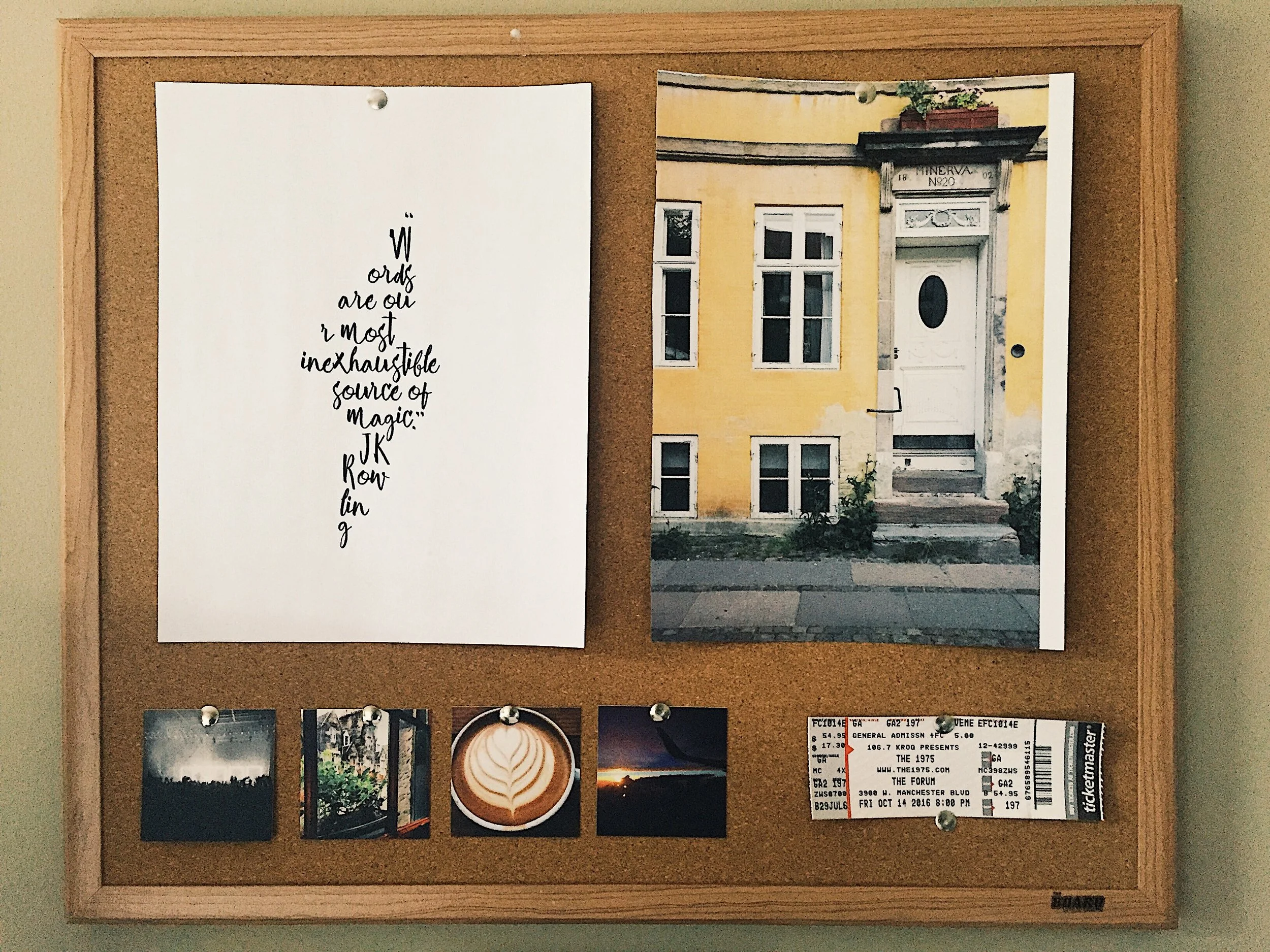

FREE PRINT

Download your free print in 3 different font options!

Last May I graduated college with a student loan balance of $29,000. Being an individual who was always mindful of my spending, this number was daunting. I had never even left a balance on my credit card.

Yet, I could still find relief in knowing that I was below the national average. 2017 graduates average nearly $40,000 in student loan debt. The United States altogether holds $1.48 Trillion in student loan debt. Talk about monstrous. And honestly, I don’t see it declining in the near future.

Even though $29,000 seemed immense, I knew that if I made smart decisions and planned accordingly I could make it work. Fast forward to June of 2018 and I’m officially free of student loan debt.

With graduates taking on increasingly more debt each year, I thought I’d share my story.